Table of Contents

Table of ContentsToggle Table of ContentToggle

Let us talk about Hull house prices. Over the years this city has been officially known as Kingston upon Hull. It has become a bit of a hidden gem for property investors.

The overall average price here stands below the UK average. This makes it an appealing option for those looking to start and expand their property portfolio.

When we first started exploring Hull’s market then we were drawn to the affordability compared to other cities in Yorkshire. You can either opt for terraced properties or semi-detached homes or even leasehold flats. The numbers are enticing.

Terraced properties in Hull tend to have a much lower average price. That too compared to semi-detached or detached homes. It is ideal if you are keen on maximising yield or keeping your initial costs down.

Rental patterns depend on the size of properties. One bedroom homes showed the biggest increase in typical rents—7.9%. Bigger properties showed a 5.4% lesser but still notable rise. These trends point to fierce rivalry for less valuable real estate. Most likely, it’s motivated by renters’ great demand and affordability.

One thing I want all investors to learn is the importance of understanding the property type.

Detached and terraced properties might look appealing for long term capital appreciation. But flats and apartments often bring higher rental yields. It is all about knowing your strategy. Whether it will be passive income or long term growth. Personally, I have seen investors succeed with both approaches in this market.

Data shows that the east riding areas of Hull have consistently offered competitive prices. That too compared to all other parts of Yorkshire. Some might overlook this city due to its smaller size.

But that is precisely why it is so promising for those in the know. The sold prices in Hull remain steady. And when compared to neighbouring cities the opportunities for capital appreciation are clear. Looking ahead, the future outlook seems strong.

Current Market Overview

Hull’s Average House Price

The average house price in Kingston upon Hull in August 2024 was provisionally recorded at £144,000. And if we talk about the last year the price was £138,000 in 2023, with a 3.7% rise over the year.

When we break it down by property type then the trends become even more evident. Semi-detached properties are known for their versatility and appeal.

They saw an impressive 4.3% increase in their average price. Meanwhile flats experienced a more modest rise of 1.4%. This is demonstrating steady demand in this segment as well.

The average price paid for properties in Hull reflects its affordability, with average prices steadily rising, offering great potential for both investors and homebuyers.

Here is a comparison of the average price of all property types–

Source: Plumplot

| Property type | Current average price |

|---|---|

| Detached | £337k |

| Flat | £101k |

| Semi-Detached | £193k |

| Terraced | £133k |

Hull house price to earnings ratio

Another thing you need to remember is smart investing. It is all about getting a clear understanding of the returns you can realistically expect over time. Investing is not just about the upfront cost. It is about knowing what your investment will yield in the future.

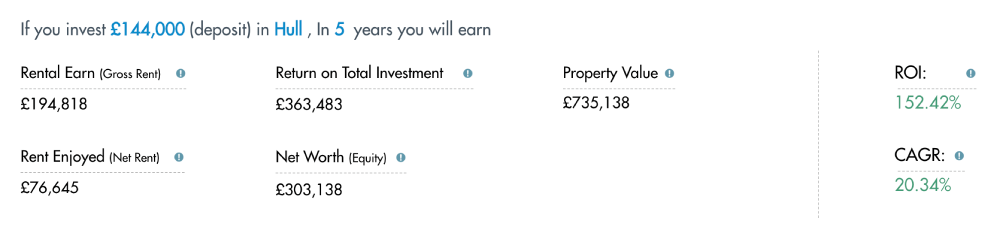

For example in Hull if you invest £144,000 today and hold it for five years then here are your returns-

So it is highly recommended to check your returns before investing in any location. And for that you can use the Passive Income calculator. Click here to reach the calculator.

Unlock Financial Freedom with High-Yield Off-Plan Properties

Our experts curate personalised, high-yield property investment opportunities to meet your investment goals.

Private Rental Prices Continue to Climb in Hull

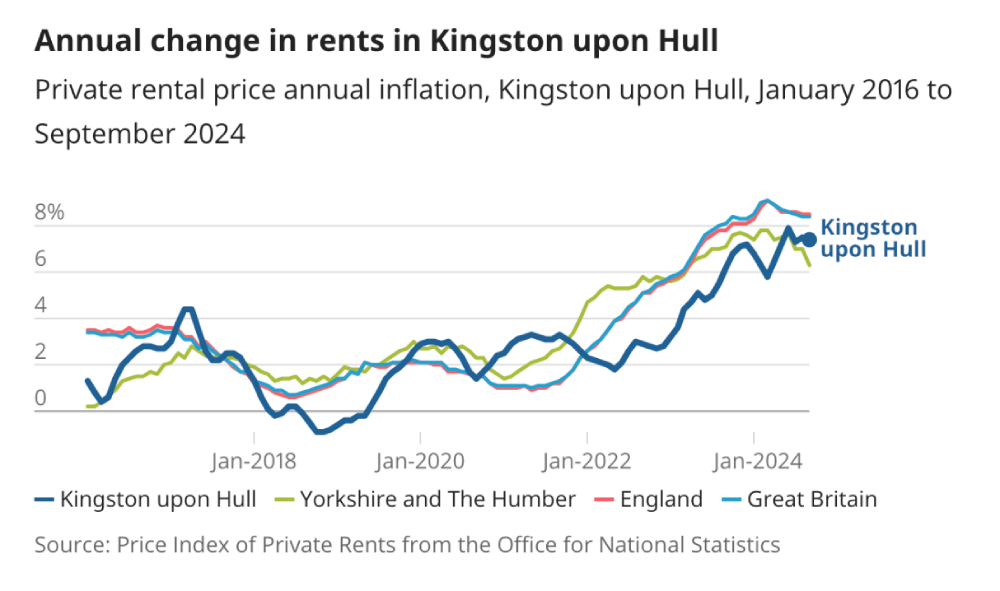

Kingston upon Hull’s private rental prices are rising. This shows a strong rental market and a rising demand. September 2024’s monthly rent was £604; in September 2023 it was £563. Based on ONS, the annual rise is rather clear: 7.4%.

Further breaking down different property categories reveals distinct rates of increase. Maisonettes and flats felt the biggest rise. The rent changed on average by 7.6%. Closely trailing with a 7.0% rise were detached properties. These numbers show how appealing Hull’s rental market is generally for a varied renter base.

As we discussed at the start of this article the one-bedroom flats showed the biggest increase in typical rents. It can be up to 7.9%. And for more profit you can also list them on short-term lets. With this you can increase your rental yield up to 15%

Source: ONS

For real estate investors, these numbers are significant since increasing rental rates increase the possibility for passive income. It also shows a solid market for those wishing to purchase rental homes. Hull is still a preferred pick because of his mix of reasonable cost real estate and growing rents.

Here is a table showing the trendy house prices and monthly rent in neighbouring areas around Hull:

| Neighbouring Area | Average Property Price (August 2024) | Average Monthly Rent | Average Rental Yield |

|---|---|---|---|

| Hull | £144,000 | £604 | 5.03% |

| Beverley | £283,274 | £957 | 4.05% |

| Cottingham | £252,969 | £945 | 4.48% |

| Hessle | £224,123 | £800 | 4.28% |

| East Riding | £233,000 | £662 | 3.41% |

How Interest Rates and Inflation Affect House Prices in Hull

Interest rates and inflation are two most crucial elements influencing Hull’s house values. These forces affect shorter-term variations as well as long-term market trends.

They affect detached residences plus terraced houses and flats too. Anyone hoping to make wise real estate investments must first understand their consequences.

Low interest rates help borrowing to be more reasonable. This simplifies getting a mortgage considerably. And let more people join the market as investors.

Naturally, growing demand drives property prices higher. During low rates, Hull’s property market has historically experienced rising trends. Especially in places with high rental demand.

During these times, semi detached properties get interest quite a bit. Their balance of cost and possible yield helps to explain this.

Conversely when interest rates rise then borrowing becomes more expensive. This can cool the market as fewer investors are willing or able to take on higher mortgage repayments. In Detached properties loan amounts are typically larger. This tends to feel the impact the most.

Low demand often translates into stabilisation or even a drop in housing prices in such times.

Inflation introduces still another level of intricacy. As inflation drives up the cost of goods and services. This reduces purchasing capability. For property investors, this means more expenses for everything from borrowing and maintenance.

However, as the value of money declines with time, inflation can also cause housing prices to rise. Hull has seen especially clear evidence of this development in east riding. Property values have increased gradually in tandem with inflation here.

Recently interest rates peaked in 2023 but have since started to ease. This is contributing to renewed growth in Hull house prices. Forecasts suggest further rate reductions by 2025. This could trigger another significant rise in sold prices. For investors, this period offers a strategic opportunity to secure properties before prices climb further.

Explore Exclusive Properties In the UK

Here is a list of some exclusive UK properties that can maximise your profit and give you higher yield.

- Hull

Deposit

.

Yield

Property Price

.

- Hull

Deposit

.

Yield

Property Price

.

Forecasting Hull House Prices for 2025 and Beyond

Experts like Savills have upgraded their five-year UK mainstream house price forecast. It has anticipated a 4% increase in 2025. And a total growth of 23.4% by 2029. While these figures are national averages they provide a useful benchmark.

Hull will also experience changes from this trend motivated by the unique mix of affordability and growth. Here still another crucial function is played by interest rates. Rates peaked in 2023; right now they are beginning to soften. This spurred fresh interest in real estate investments.

2025 is expected to bring even further cuts. This could boost demand and thereby drive property prices upward.

One further thing to think about is inflation. Building materials and personnel cost increase along with the cost of goods and services. Property values could so be raised. Should income lag behind, affordability could start to cause issues. At last it can lower demand.

Property values might also be affected by local Hull Kingston projects. This covers infrastructural enhancements and projects for urban renewal. This further pushes house prices up.

Moreover, house prices are influenced by government policy and investment incentives. They influence investment prospects and market dynamics. Making wise choices in property business depends on awareness of these elements.

Here is a list of Price forecasts from 2025 and beyond.

| 2025 | 2026 | 2027 | 2028 | 2029 | Total Growth | |

|---|---|---|---|---|---|---|

| Average UK price growth (%) | 4.0% | 5.5% | 5.0% | 4.0% | 3.0% | 23.4% |

| CPI inflation (year-end) | 2.5% | 2.1% | 2.1% | 2.1% | 2.0% | 11.3% |

| Nominal income growth | 2.9% | 2.6% | 2.5% | 3.1% | 3.0% | 15.0% |

| Real GDP growth | 1.5% | 1.7% | 1.7% | 1.6% | 1.6% | 8.3% |

Source: Savills

How Government Policies and Incentives for Investors Influence Prices

Government policies and investor incentives significantly influence house prices in Hull. They shape the market dynamics and investment opportunities.

Understanding these factors is crucial for making informed decisions in the property sector.

Stamp Duty Land Tax (SDLT)

Adjustments to SDLT directly impact property transactions. For instance the recent increase in the stamp duty surcharge for landlords from 3% to 5%.

This has led to disruptions in the market. This is due to some transactions falling through due to higher tax liabilities. Such changes can reduce the number of properties sold and also start influencing the overall average price in areas like Hull.

Initiate a powerful sequence of your property growth and reinvestment.

Initiate a powerful sequence of your property growth and reinvestment.

Unleash how successful investors build wealth, reduce financial stress, and achieve financial freedom.

Capital Gains Tax (CGT)

Variations in the CGT tax free allowance can influence the behaviour of investors. Plans aim for a reduction in April 2023 from £12,300 to £6,000 then to £3,000 in April 2024.

This could make landlords examine their portfolios. But it is potentially leading to a decrease in available properties. It lead to an increase in house prices due to reduced supply.

Conclusion

Hull’s property market is an exciting opportunity for investors. House prices in Hull offer a balance of affordability and growth potential. The average price of properties sold here remains competitive compared to other parts of Yorkshire.

Also the overall average price reflects steady growth. From semi detached properties to detached properties you can go for any property type. There is a property type to suit every investment strategy.

Government policies plus economic factors and local development projects in Hull all influence house prices. They create fluctuations across periods. Comparing leasehold and freehold property types offers insights into how to approach different investment options.

The strength of the rental market in Kingston ensures steady returns. Especially in areas with increasing sales activity.

By keeping a close eye on sold prices with comparison data and regional trends investors can make strategic decisions.

Hull’s housing market is more than just numbers. It is a thriving environment for those ready to act. House prices in Hull are steadily rising. Now is the time to make the most of the opportunities this dynamic city offers. With the right approach your investment can become a cornerstone of your financial future.

Exclusive Property Launch Invitations

Exclusive Property Launch Invitations Customised Market Reports

Customised Market Reports Exclusive Access to Off-Market Properties

Exclusive Access to Off-Market Properties Networking Events

Networking Events